This is the first of two parts in our assessment of the PJM Market and Distributed Energy Resources

In Our Assessment…

- Distributed Energy Resources or DERs are increasingly valuable to End Use customers, driven by more efficient technologies and higher “controllable” electricity cost components

- The low hanging fruit of the “Value Stack” continues to be reduction of Transmission and Utility Delivery Costs, but new technologies and more friendly market design are supplementing those value drivers with other opportunities

- DERs may participate in the Ancillary Services market, but the extent of involvement depends on the End User customer’s operational needs and the DER system configuration

- Historically most DERs have supported load requirements and things get complex when considering investments to maximize value opportunity

- Asset Managers and Project Developers support and facilitate value creation for dispatchable DERs through their access to market signals and controls technologies

- Batteries are an interesting DER investment option inasmuch as they can enable all facets of the DER Value Stack and aren’t limited by many of the same environmental entanglements as generators.

The Value Drivers

Transmission

Transmission costs are based on the capacity dedicated to serve the peak load demand in what is called the peak load contribution or “PLC”. The level of demand is based on the premise that in order to serve the load the system requires the level of capacity to maintain the infrastructure. This is a regulated rate that is set for distinct areas across the PJM network. The PLC is generally set over time based on peak demand days that coincide with the system peak demands; the precise methodology varies by utility. The PLC sets the level of transmission for the subsequent calendar year. Reducing the PLC will result in a reduction in the transmission cost for the following year across all the billing periods.

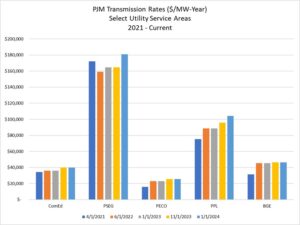

Transmission rates have generally increased over time, with substantive increases in the PSEG and PPL service territories. These utility areas also have the highest effective rates amongst the major utilities in PJM.

Utility Delivery

Large commercial and industrial customers pay for delivery services based on demand and in some cases usage as well. This depends on the utility, and that is largely driven by the total cost of service, the nature of the rate base and rate design approach adopted by the utility. Many utilities base the demand charge on the PLC discussed above. In competitive markets the delivery costs are decoupled from the supply costs for purposes of shopping. The delivery and supply rates are separately regulated and set by each state’s utility commission. Similar to Transmission costs, demand-related charges can be managed to a significant extent by managing demand levels through the control of load or the use of distributed generation, or both in combination.

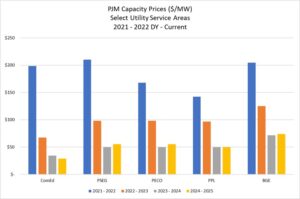

Capacity

The PJM capacity market ensures long-term grid reliability by securing the appropriate amount of power supply resources needed to meet predicted energy demand in the future. Capacity market participants offer power supply resources into the market that provide supply or reduce demand. These resources include generators, upgrades for existing generators, demand response, energy efficiency and transmission upgrades. DERs have enabled or have been a participant in the Capacity market for quite some time.

Ancillary Services

The PJM ancillary service or “A/S” markets are Regulation and Reserves. Reserves can be Primary or Supplemental, the difference being the synchronization with the grid and the time in which the resource is able and committed to being available. Primary Reserves must be able to provide energy to the grid within 10 minutes of the call and Supplemental Reserves have a window from 10 to 30 minutes. A/S services are bought in the market from generation/storage and load resources to support healthy grid operations. The Reserves market operates both day-ahead and real-time.

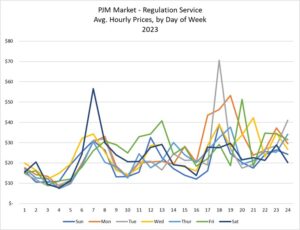

The Regulation market is a real-time market exclusively. Regulation is provided by generation resources and demand response resources that qualify to follow one of two regulation “signals”, RegA or RegD. These resources are under automatic control by PJM. PJM jointly optimizes Regulation with Synchronized Reserve (a Primary product) and energy to provide all three products at least cost to market participants. The Regulation D signal is a fast, dynamic signal that requires resources to respond almost instantaneously. Regulation A is a slower signal that is meant to recover larger, longer fluctuations in system conditions. These two signals communicate with each other and work together to match the system need for regulation. Daily Regulation offer prices are submitted for each unit by the unit owner. Owners are required to submit a cost-based offer and may submit a price-based offer. Offers include both a capability offer and a performance offer. Owners must specify which signal type the unit will be following, RegA or RegD. There is a debate about the price methodology and whether or not Reg D is being overvalued, but that is not a topic we will tackle in this blog.

DERs are able to participate in all products of the A/S markets depending on the system configuration and the requirements of the End Use customer’s operational needs. Resources cannot be committed for more than one of the Non-synchronized Reserves, Synchronized Reserves, or Regulation products during the same time interval.

For 2023 the unweighted average price for Reserves in the day ahead market was $2.17 per megawatt for Primary Reserves and $2.65 per megawatt for Synchronized Reserves. The unweighted average price for Regulation was $21.15 per megawatt. Secondary Reserves were either not offered or did not clear during 2023. Regulation averaged roughly $21 per megawatt hour during the year. Prices for Regulation are highest on evenings during the week, and generally trend up during the day.

In Part 2 of this blog, we will discuss battery storage and the Value Stack and apply our DE DealViewTM analytics to evaluate various investment cases for DERs, including battery storage systems.

Sources: PJM, ComEd, PSEG, PECO, PPL and BGE