The U.S. battery energy storage market has been on a remarkable growth trajectory, with each sector—residential, commercial & industrial (C&I), and grid-scale—expanding rapidly in response to declining costs, policy support, and increasing demand for energy resilience.

Residential Storage

- Momentum has been building since 2021, with homeowners increasingly investing

- in battery storage for backup power and energy independence.

- By Q4 2023, deployments hit 218.5 MW, slightly up from 210.9 MW in the previous quarter.

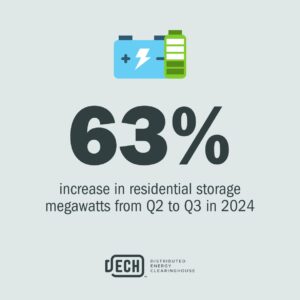

- The real breakthrough came in 2024, with residential installations soaring to 346 MW in Q3, a 63% increase over the prior quarter—an all-time high!

Commercial & Industrial (C&I) Storage

- Early growth was modest, but businesses quickly recognized the value of energy storage for demand charge management and backup power.

- Key markets like California, Massachusetts, and New York saw notable adoption in 2023, with C&I deployments reaching 33.9 MW in Q4.

- While detailed 2024 figures are limited, the overall expansion of energy storage suggests continued positive momentum.

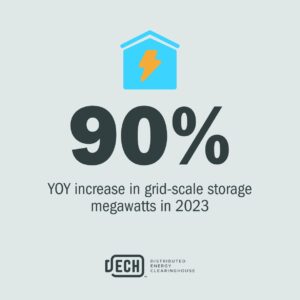

Grid-Scale Storage

- The fastest-growing segment, grid-scale storage capacity doubled by mid-2021 and reached 9 GW by the end of 2022.

- 2023 set new records, with 3,983 MW (11,769 MWh) deployed in Q4 alone, contributing to a 90% year-over-year increase.

- Growth continued into 2024, with Q3 deployments reaching 3,431 MW (9,188 MWh)—an 80% jump from Q3 2023.

Market-Wide Expansion

From 1,756 MW at the end of 2020 to over 9 GW by 2022, the battery storage sector is scaling at an extraordinary pace. In 2024 alone, the U.S. added 10.3 GW of new storage, a 70% increase from the prior year.

This rapid expansion is driven by falling battery prices, federal incentives (like the Inflation Reduction Act), and the push for renewable energy integration. With energy resilience becoming a priority across industries, all signs point to continued growth in the years ahead.