Natural Gas remains the king in Texas, at least for behind the meter distributed generation at commercial and industrial locations. We waded through information on the Texas PUC website’s list of registered generating entities and the ERCOT website to make some observations and draw some conclusions.

Here are our take-aways…

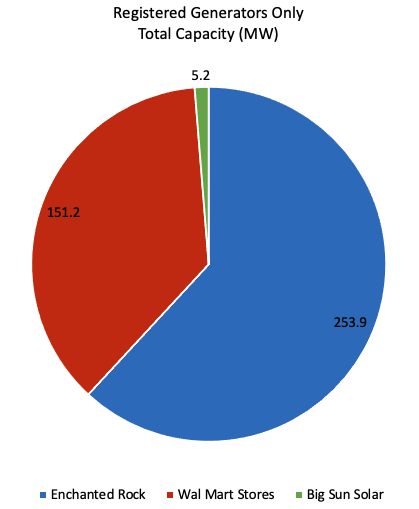

Enchanted Rock is overwhelmingly the Market Leader

Currently, Enchanted Rock has nearly 254 megawatts of distributed generation capacity at 3rd party sites, including HEB and various utility districts. Most if not all this capacity is natural gas fueled. Wal-Mart has installed distributed generation at many of its stores in Texas, but of course they are not developing this generation to serve others. Other players, including RPower, PowerSecure and RavenVolt have also entered the Texas market with their distributed generation solutions.

Reliability is at a Premium for End-Users

With Enchanted Rock and Wal-Mart having the vast majority of distributed generation capacity, and with those installations largely at retail and critical load locations, over the past decade reliability is highly valued by retailers and utility district end-users. For clarity, these systems are not “standby generation” in the traditional sense as they are of course grid-connected.

Commercial Solar is lagging Natural Gas in Texas

Big Sun Solar is the largest developer of commercial behind-the-meter solar, with an average installed capacity per location of roughly 500 kilowatts. There is no other notable developer of behind-the-meter solar at this time, but players like Agilitas and Catalyze are now entering the market with solar and battery solutions, some of which will be behind-the-meter. We expect to see the results of their efforts later this year.

Texas Distributed Generation Developers

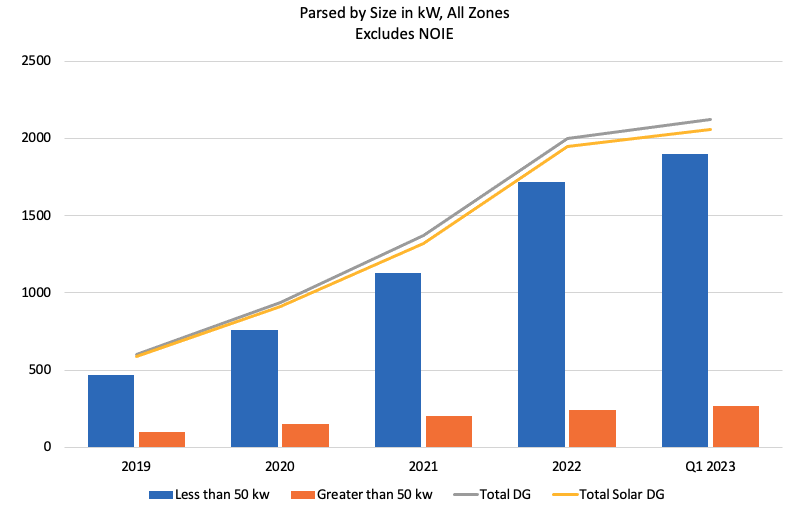

Most Behind-the-Meter Solar Development is Residential

Total unregistered distributed generation in ERCOT is just over 2 megawatts. These are smaller installations that are typically less than 50 kW. Nearly all of this generation is solar. The total capacity represented by Enchanted Rock, Wal-Mart and Big Sun of about 410 megawatts is nearly 200 times that of this unregistered solar capacity. The chart below does not reflect distributed generation capacity for non opt-in entities such as Austin Energy or CPS in San Antonio, so these numbers from ERCOT may under-represent total residential distributed generation.

ERCOT Unregistered DG Installed Capacity (kW)

Sources: Public Utility Commission of Texas, ERCOT