This is the second of now three parts in our assessment of the PJM Market and Distributed Energy Resources

In this second part of our Blog on DERs in PJM, we take a deeper dive into value opportunities for Energy Arbitrage and Ancillary Services.

Energy Arbitrage

There is considerable investment activity around battery energy storage systems, or BESS, both in front of the meter and behind-the-meter. We are interested in what value is available to owners of BESS from an arbitrage perspective – that is charging the battery from the grid during times of lowest prices and discharging it during times where prices are highest.

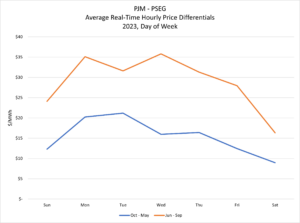

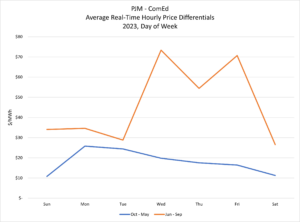

Our analysis is limited in that we only looked at 2023 for price history. In our analysis, which we performed for the PSEG and ComEd zones within PJM, we calculated the average real-time price across each day across the year and looked at the results from a seasonable perspective. The price differential is calculated by deducting the average price for the two lowest price intervals from the two highest price intervals for each day during the month, and then averaging those over a seasonal grouping. We decided to group the results for the period of October through May and then June through September.

From these results we observe that the hourly differential is considerably higher in the June through September (roughly the summer months) than the October through May results. The seasonal differential is roughly $13 per megawatt-hour in the PSEG zone, and more than $25 per megawatt-hour in the ComEd zone. The price differentials are lowest during the weekends. See Charts A and B below. It is interesting to note that the price differentials during the summer months in the ComEd zone are quite high for Wednesdays through Fridays. We took a deep dive into the data and noticed several interval prices in excess of $500 per megawatt-hour in the June through September time period that substantially skewed the average prices much higher.

The value differential for BESS of one megawatt-hour in the PSEG zone has a value of roughly $4,800 for a year, and a value of $9,500 in the ComEd Zone. This contemplates that BESS is charging and discharging each day to achieve the one megawatt-hour performance and hitting these values on the nose.

Ancillary Services

BESS also has potential in the Ancillary Services market. Here we start with looking at the prices for Regulation and Synchronous Reserves. Just as we did with energy prices, we looked only at 2023 for price history.

Regulation Service

PJM posts clearing prices for the regulation market – the Regulation Market Clearing Price or RMCP, the Performance Clearing Price or RMPCP and the Capability Clearing Price or RMCCP. The RMPCP is based on the marginal performance offer for each hour. The RMCCP is equal to the difference between the RMCP and RMPCP for each hour. The methodology maximizes the value of RMPCP – the capability clearing price.

During 2023 the regulation market clearing price or RMCP averaged $21.08 per megawatt. Practically speaking, BESS can only participate in this market for 8% of monthly hours, or 60 hours in total for a month. This generates roughly $15,000 in revenues annually for a megawatt-hour.

Synchronous Reserves

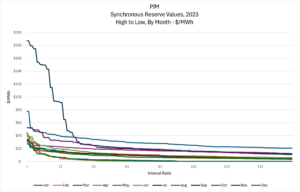

Synchronous Reserves are additional generation capacity or resources, including BESS, above the expected load. BESS enrolled in the ESR participation model, must be able to provide a minimum of 0.1 MW of Tier 2 Synchronized Reserve Capability in order to participate in the Tier 2 Synchronized Reserve Market. Any resource that is committed for Tier 2 when a synchronized reserve event occurs is obligated to respond for their commitment at the start of the event within 10 minutes.

We ranked the hourly prices for synchronous reserves for each month, up to 160 hourly intervals. We then assumed we were able to realize on average the 30 highest priced intervals each month during the year. This represents a dispatch capability of one megawatt-hour each day during the month and year. Using this simplistic approach, the estimated annual revenue opportunity is roughly $10,600 for a megawatt-hour.

Comparison of Regulation and Synchronous Reserves

As discussed above, based on 2023 prices, the value available from Regulation service is roughly 50% higher than that from Synchronous Reserves, and that would be the preferred strategy for selling Ancillary Services to the ISO.

BESS Asset Management Considerations

Let’s consider first that decisions are made in the day-ahead market when an asset manager can observe the DAM energy market and Ancillary Services prices. Assuming that the value of Ancillary Services, in this case Regulation Service, is at a premium to energy, the Regulation capacity is committed and is “take or pay” with the ISO.

In that committed hour, if the Regulation is not called on by the ISO, the value has already been realized via the committed Regulation and the asset manager is now free to sell energy into the RTM. The asset manager may also consider avoiding discharge of the BESS asset and evaluate the prices in the DAM for energy and Ancillary Services.

Our Takeaways

Battery Energy Storage Systems are increasingly valuable assets for load and the grid in general. In a distributed energy or microgrid setting they provide flexibility and options which are difficult for generation or load reduction to achieve. For 2023 the percentage of BESS providing Regulation Service of total Demand Response has increased to nearly two-thirds of the settled MWh’s from the level seen in 2022. We expect that trend to accelerate somewhat in the coming years. Energy injection from BESS is lagging in PJM since there is not good value available on a consistent basis.

In Part 3 of this blog, we will evaluate various investment cases for DERs, including battery storage systems.

Sources: PJM, ComEd, PSEG